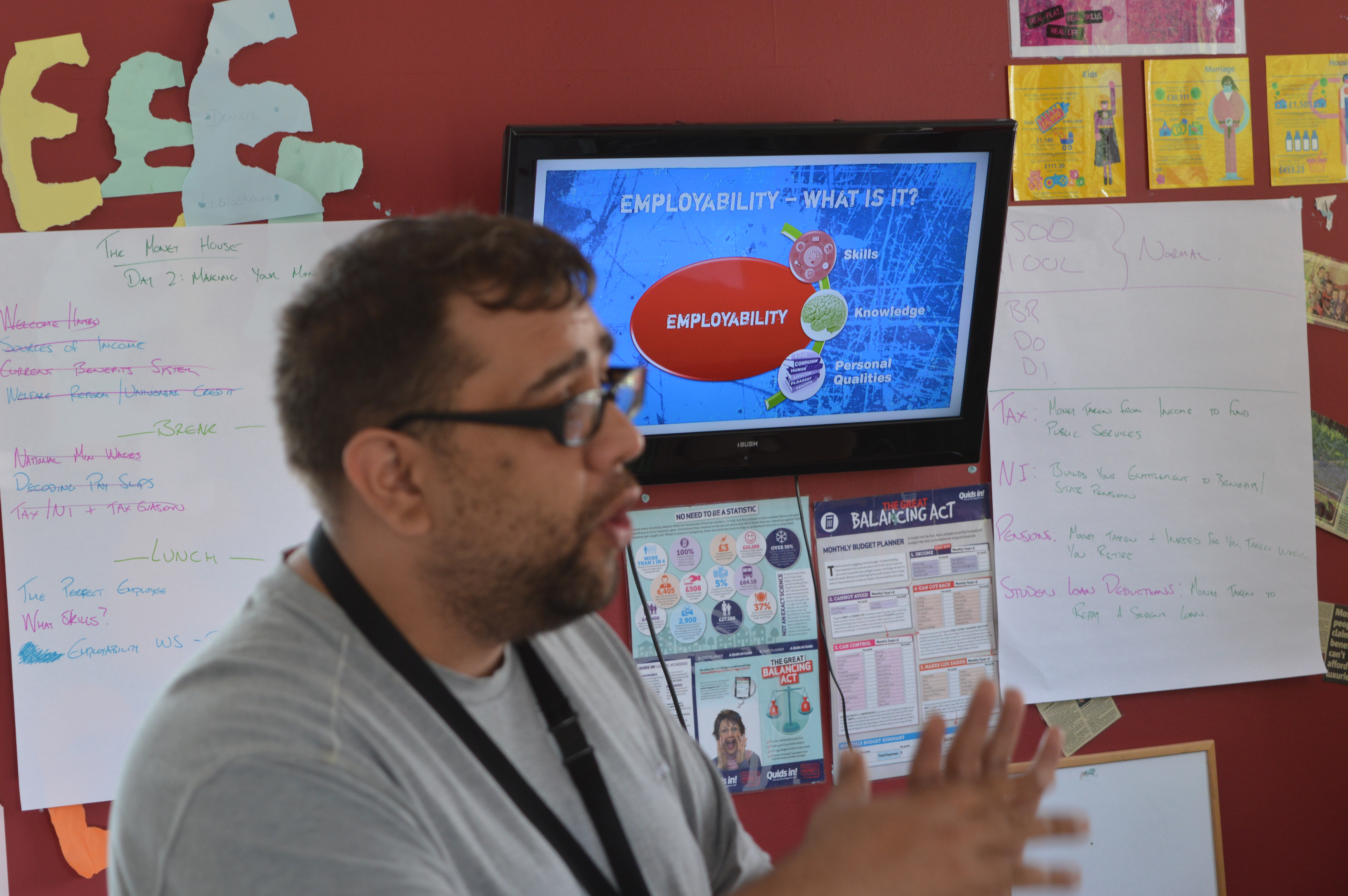

Jaymie is 19 and on day three of our five day financial education programme for young people, The Money House.

This piece originally featured in 24 Housing.

“I’ve been living in supported lodgings for over seven months now. You may not have heard of it, but it’s where someone gives up a room in their house for you.

I have my own space here, sort of, I prefer it to a hostel 100%, but, I want my own place. Coming to The Money House is the last thing I have to do before I get my bidding number.

When I first found out I was doing an independent living course I reckoned it was going to be intense, serious like a school test. It was nothing like I thought it was going to be!

I’ve been here three days and everything has been useful and exciting. Bills, rent, employability, avoiding debt and debt management. I would not have been told these things in this way and depth by anybody else.

It’s also taught me a lesson. I wish I had known what to do when you move in, like letting all the utilities and suppliers know I’m the new resident. I made that mistake before and it cost – it would have cost me again.

The set up here helps, working with small groups of young people, just like me and going through the same situation. Hearing experiences, similar and different, because they may have been through stuff you’ve yet to go through. It’s the opposite of a classroom, very interactive, enjoyable, easy.

I’d say to a young person being told or thinking about doing The Money House, you will learn so much more here than going through the counselling process. It’s a proper breakdown of the system, step by step, how to live on your own. It’s been so insightful. I’d recommend anyone to do this as part of your pathway”.

The Money House is an accredited week-long financial literacy programme aimed at preventing youth homelessness. Run by the charity MyBnk, it takes referrals on a continuous basis and is mandated by several local authorities. Based in Greenwich and Newham, London.