MyBnk caught up with Gemma and Andreu, who front our latest financial education outpost in Scotland. We talk poverty, Pythagoras and a reluctance to discuss dosh.

So, what are you doing here?

Gemma

Delivering financial education for young people!

Delivering financial education for young people!

We’re focusing on building positive money habits in primary schools and helping young adults move into independent living. Being based locally I’m able to work closely with teachers and youth workers. This helps us understand the specific challenges young people here face.

Despite Scotland taking money lessons further than other home nations, it faces the same obstacles in terms of quality and outcomes.

Scotland also has unique challenges due to high levels of deprivation. One of the schools I’ve been working in recently lost three students in tragic circumstances. It’s brought home some of the root causes and consequences of poor mental health and poverty.

Andreu

I’m helping young people have more awareness about their relationship with money and have the right tools and information to make informed choices. And having lots of fun along the way!

Talking about money tends to make us feel uncomfortable, so we avoid it. We get young people to consider what they really need or want and how to pay for things. Then the penny drops and they start to see the world around them with more critical eyes.

Tell us about yourself

Gemma

I started off as an English teacher in Vietnam and Romania, before qualifying as a secondary school teacher back in the UK. I’ve also spent four years working for the Dogs Trust, teaching children how to keep safe around dogs – now, it’s money…so, same same!

The number one thing I hear in this job is: “Why didn’t I learn this in school?!”

To date, I’ve found no practical use for Pythagoras’ theory but I do remember needing help with budgeting – especially when I first lived at university. I felt I was good at managing money because I’d had small earnings from part time jobs for a few years, but it was an entirely different experience trying to budget large student loan deposits across three months. I was lucky enough to have supportive parents who helped me out. Without them, I would have fallen into debt and struggled financially.

Andreu

After living in many places in England and around Europe, I couldn’t be happier to be in Glasgow, the great city at the gateway to the Highlands. I worked in different roles mostly with children and young people in schools, information services and accommodation providers, as well organising international programmes.

In Scotland, I am loving the great sense of community and how civil society leads great not for profit organisations I have the pleasure of working with, making a difference to people’s lives on a daily basis.

What have you seen on the frontline?

Gemma

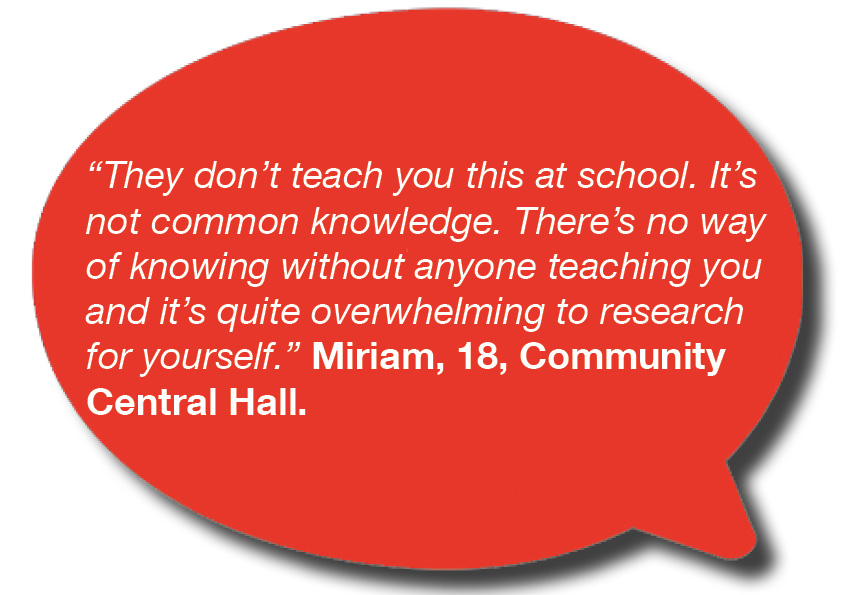

In general, I’ve found a lot of bravado from young Scots: they often have a front that suggests they’re not interested in financial education. In reality, they’re often feeling uncomfortable or embarrassed – they don’t want to admit there are things they don’t know about money, particularly in front of others.

It’s a taboo subject and fits into a general trend across the UK where we’re reluctant to discuss money and the issues surrounding it. As a result, I find the young people gain much more from the MyBnk sessions than they expect to. There are so many areas of money management they had no idea even existed. Exposure to this in our sessions boosts their confidence and overall understanding.

Andreu

Many young people I work with have great money habits, projects and dreams but need some help in learning how to make the most of what is in offer and build confidence. In the same way, many have mindsets or patterns of financial behaviour which may lead to financial difficulties because of the reality they have lived. Some environments can seriously harm our ability to imagine a different financial situation, so this is an obstacle some young people must overcome.

In our sessions, we explore what is right for each young person, which may be different to what is right for their friends or family. We make sure young people feel at ease so they can ask vital questions to inform their choices.

What are you delivering in Scotland?

- Money Works – A survival money management programme for 16-25 year olds not in education, employment or training. Our sessions explore survival money management, including budgeting, living independently, banking and borrowing. Virtual version also available.

- Money Twist P3/4/P5/6 – A series of primary school based sessions for 7-11 year olds focusing on forging positive money habits such as saving and delaying spending gratification.

- Money Twist S4/S5/6 – These programmes cover practical and relevant everyday financial matters including budgeting, needs vs wants, careers, tax, banking, interest, and savings.

Where are you delivering it?

All over Scotland!

Our young adult offerings can be delivered virtually via Zoom anywhere in Scotland. We are working with groups in Inverness and Aberdeenshire, right down to Dumfries and Galloway.

Our school-based programmes are now only offered in-person. For these deliveries we mostly stay in the Central Belt, with a bit little of further reaching into areas such as Perth, Dundee and Ayrshire.

But there’s always the odd exception, so feel free to ask about options for us coming to visit you in-person, if that’s what you feel your young people would prefer.

Who is funding you?

Our work in Scotland has been funded by a number of different fantastic supporters, including: the Hymans Robertson Foundation and the Robertson Trust, the Agnes Hunter Foundation and the Gannochy Trust. We also have funding from The Centre for Financial Capability to deliver our primary school sessions.

Who are your partners?

We work with a wide range of organisations. Across Scotland, we work with a number of Prince’s Trust partners on their Team employability programmes. We also work nationally with Barnardo’s in a number of locations, both virtually and in-person.

More recently, we’ve begun partnering with organisations who support care-experienced young people in places like Stirling and Aberdeenshire. Our Money Works sessions, both online and in-person, are starting to reach more and more of this group.

What’s next?

The future looks bright! In Spring 2022 we have fantastic plans to open a Money House in Glasgow to support young people moving into independent living. This will help us to meet our ever-growing demand and also to reach some of the groups most in need of this vital education.