Positive financial habits are essential to living independently – Discover why and how we help

Why we do it?

Everyone needs to be able to manage their money.

But for young people the inability to do so has serious consequences; it is easier to fall into debt, be scammed, make uninformed decisions and establish bad money habits.

2022 was dubbed as ‘the year of the squeeze’ with an average household £1,200 worse off than in 2021. Without knowledge of financial concepts, products or the economic state they are about to enter, how can today’s young people thrive as adults tomorrow?

Higher incomes, consumer protection and better products are all important for improving financial wellbeing, but it is essential young people are educated and equipped to make the right money choices for themselves. There are many sources of tips and guidance but much is irrelevant, of un-proven impact or linked to selling.

Through the delivery of impactful and evaluated financial education, MyBnk can help to break these cycles for young people as they transition into independence.

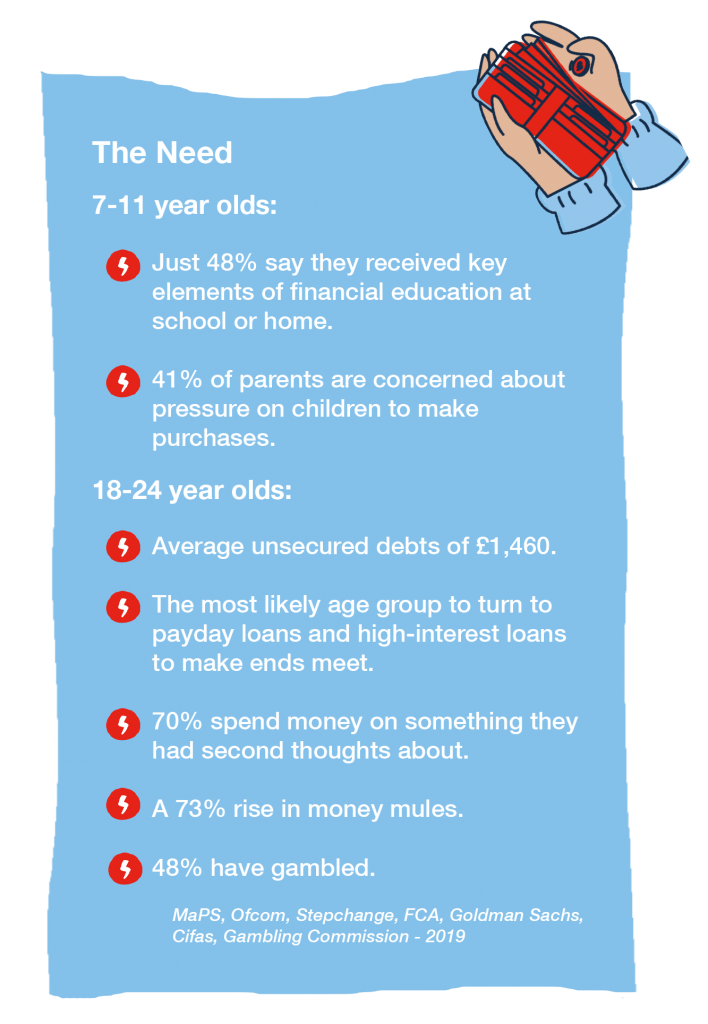

The Need for Financial Education

Young people engage with money from an ever earlier age but face a financially challenging future.

Young people engage with money from an ever earlier age but face a financially challenging future.

When MyBnk started in 2007, just 10% of UK adults had received any form of financial education. In 2011 we joined others and successfully campaigned for money lessons to become part of England’s national curriculum, from Year 7 to GCSE level.

Although there is wide advocacy for financial education, there remains substantial gaps in relevant, effective and evaluated provision. With timetabling pressures, the absence of extra funding and limited specialist training, evidence and experience tells us schools are struggling to deliver impactful lessons. Moreover, students in primary schools, academies, sixth forms, colleges and free and independent schools are not required to be taught money skills.

How We Do It

Budgeting, costing structures, taxes can be traditionally boring or challenging topics for young people.

MyBnk takes a holistic approach to education, using real life case studies, colourful resources, games, videos and links to popular culture to bring money to life, whilst catering for different age groups, backgrounds and abilities. Our sessions challenge negative financial attitudes and build self-belief as well as develop appropriate knowledge and skills.

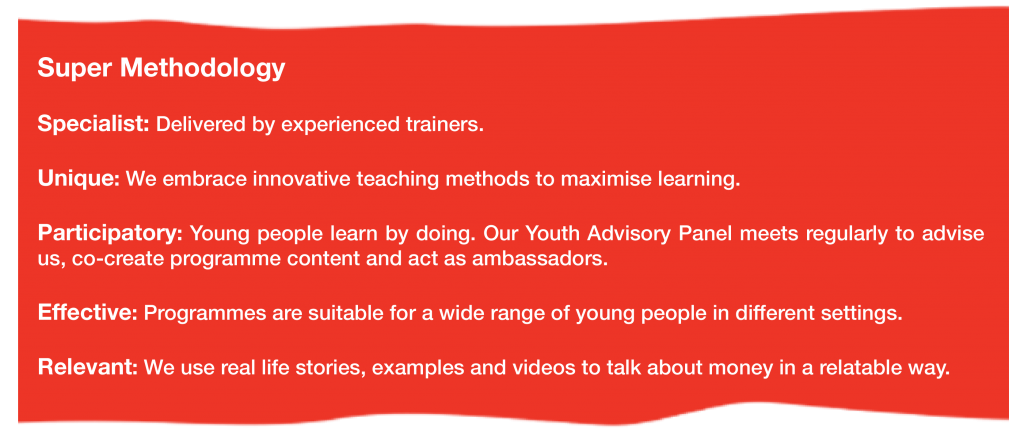

Our SUPER methodology ensures young people get trustworthy, reliable and expert information.

Many of our programmes are fully funded and can be delivered either directly in-person, virtually via secure video link, or as online courses.

Quality & Training

We convey appropriate learning in an exciting way, leaving young people with a positive memorable experience and a desire to learn more about money beyond the classroom.

If you do something you might as well do it right. This is true when looking at important topics such as finance, and independent living. That is why we employ full-time paid professionals with a background of working with young people.

Out of mainstream education

Our out of school approach shifts, especially when working with young people in vulnerable circumstances, who may have low self-confidence when managing their money.

So, our programmes contain a strong element of challenging negative attitudes, building self-belief and aspirations to move forward financially.

Our History

From working in education in Zimbabwe and Brac in Bangladesh, inspired by Grameen Bank microfinance, and with help from fellow entrepreneurs – the story of MyBnk starts with our founder Lily Lapenna.

Our founder and former CEO has a background in international development in Africa and Asia. She saw how financial education can unleash potential, giving way to better money skills and self-sufficiency.

Annual Reports

Our 2024-27 Strategy – Money: A Language for Life

As we look ahead, MyBnk is poised to embark on an exciting phase of growth and innovation. Our 2024/25 business plan marks the first year of our new strategic plan, driving forward our mission to deliver impactful financial education and create a financially fluent population.

This year, under our Money: A Language for Life Strategy, we will double our efforts to create learner-centered programmes and expand our reach to support older cohorts navigating key financial milestones. We are committed to increasing accessibility for those most in need and tackling inequality by being bold advocates for high-quality financial education for all across the whole of the UK. Alongside these priorities, we will continue to transform our internal systems and processes, investing in our people and culture (under the leadership of our inaugural People and Culture Director), to ensure we are equipped to meet the challenges ahead.

Learn more about our 2024-27 strategy here.

This is the power of financial education: helping people navigate their money with confidence, no matter where they started.